Is Dropshipping Taxable in the USA?

If you’re building a dropshipping business in the United States, one of the first questions that comes up is: “Do I have to pay taxes on my dropshipping income?”

The short answer is yes. Dropshipping is a real business, and just like any other business in the U.S., it’s subject to taxes.

But don’t worry, paying taxes as a dropshipper isn’t as complicated as it sounds. Once you understand how it works, you can stay compliant, avoid surprises, and keep more of your profits.

In this post, I’ll explain everything you need to know about dropshipping taxes in the USA, including income tax, sales tax, and how to handle them the smart way.

Is Dropshipping Taxable?

Yes, dropshipping is taxable in the U.S. because you are running a business that generates income.

There are two main types of taxes you need to be aware of:

Let’s break both down.

1. Income Tax for Dropshipping Businesses

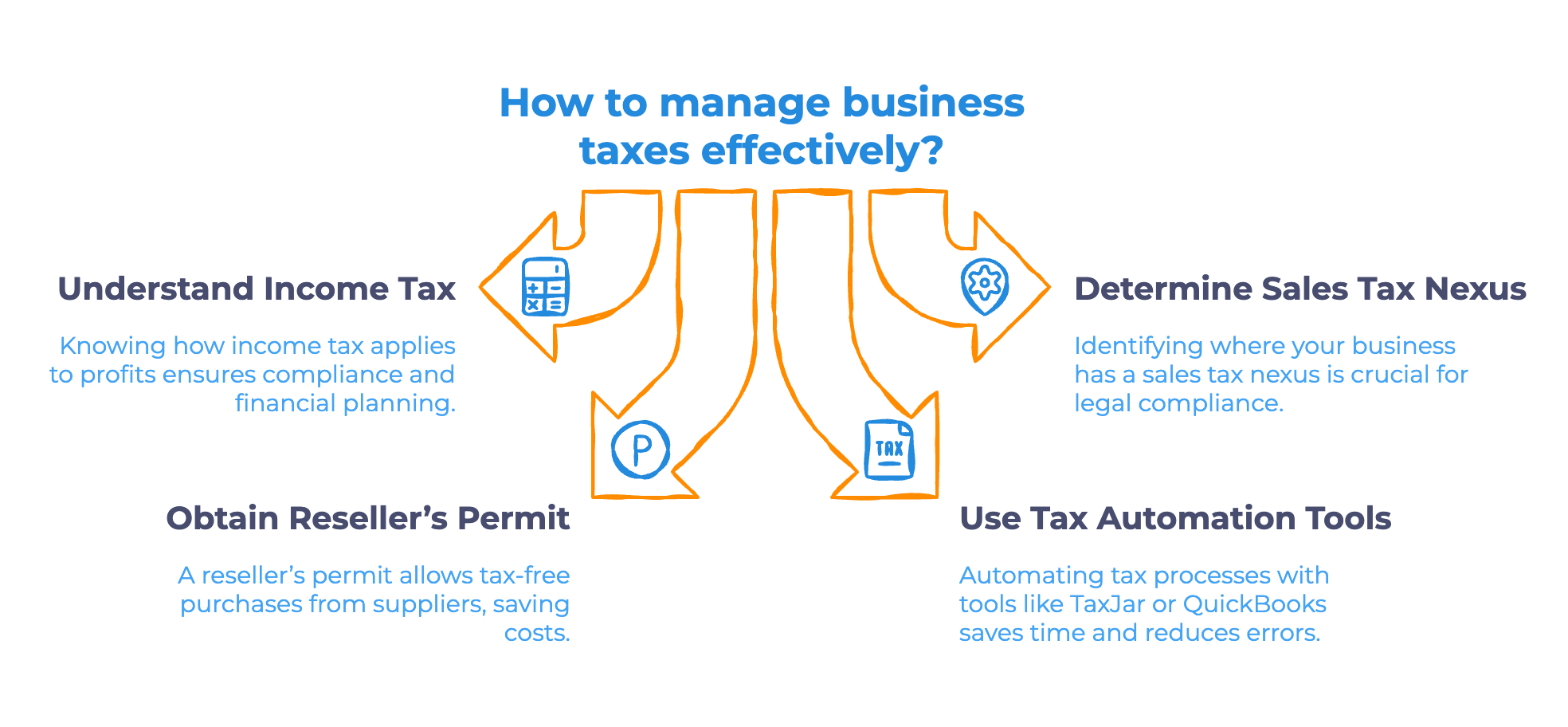

Income tax applies to the money your store earns after expenses. Whether you run your dropshipping business as a sole proprietor, LLC, or corporation, you’re required to report your income to the IRS.

Here’s how it works:

- If you’re a sole proprietor or single-member LLC, you’ll report your income on your personal tax return (Form 1040, Schedule C).

- If you have a multi-member LLC or corporation, you’ll file a separate business tax return.

The key thing to remember is that you’re taxed on profits, not total sales. That means you can deduct business expenses such as:

Tracking these expenses accurately is essential. Using software like QuickBooks or Xero can make it much easier when tax season comes around.

2. Sales Tax for Dropshipping Orders

Sales tax is where most beginners get confused.

In the U.S., sales tax laws vary by state, but in general, you’re responsible for collecting sales tax when you have a “nexus.”

A nexus means a connection to a specific state. This could be:

If you have a nexus in a state, you must collect sales tax from customers in that state and remit it to your state’s Department of Revenue.

Here’s an example:

If your business is registered in Texas, and you sell to a customer in Texas, you’ll collect Texas sales tax. But if that same customer lives in California and you don’t have a nexus there, you don’t need to collect sales tax on that order.

That said, tax laws are changing. Many states have adopted “economic nexus” rules that require businesses making a certain number of sales or reaching a sales threshold in that state to collect sales tax, even without a physical presence.

This is why it’s important to check the latest tax requirements for your state.

3. Do Suppliers Charge Sales Tax?

If you’re buying products from U.S.-based suppliers, they may charge you sales tax on your orders, unless you have a reseller’s permit (sales tax exemption certificate).

A reseller’s permit allows you to buy products from suppliers tax-free because you’ll be collecting sales tax from your customers instead.

Most legitimate suppliers will ask for a copy of your reseller’s certificate before approving your account.

You can apply for one through your state’s Department of Revenue website.

4. How to Collect and Pay Sales Tax

If you sell through Shopify, it’s simple to set up automated sales tax collection.

Go to your Shopify settings → Taxes and Duties → and enable sales tax for your nexus states. Shopify will automatically calculate the correct rate based on your customer’s location.

Then, once per month or quarter (depending on your state), you’ll file a sales tax return and remit the tax you collected.

Tools like TaxJar and Avalara can help automate this process completely, from collecting the right rates to filing your returns.

5. Dropshipping Taxes for International Sellers

If you live outside the United States but sell to U.S. customers, you still need to understand U.S. tax laws.

Typically, if your business is registered outside the U.S. and you don’t have a physical or economic nexus in any U.S. state, you’re not required to collect U.S. sales tax.

However, your home country may still tax your income from your dropshipping business. Always consult an accountant familiar with international eCommerce to stay compliant in both regions.

6. How to Stay Compliant and Avoid Penalties

Here are the best practices I follow and recommend to all Drop Ship Lifestyle members:

A little organization goes a long way when it comes to taxes. The last thing you want is to find success and then get hit with unexpected tax bills because you didn’t set things up correctly.

Final Thoughts

So, is dropshipping taxable in the USA?

Yes. Like any business, you’ll pay income tax on profits and collect sales tax where you have a nexus.

Here’s the good news: once your systems are in place, taxes become routine. Shopify, accounting tools, and automation software make it easier than ever to stay compliant.

To recap:

If you want a step-by-step system that shows you exactly how to start, scale, and run a legitimate high-ticket dropshipping business, join my free training at DropShipLifestyle.com/webinar

The post Is Dropshipping Taxable in the USA? appeared first on Drop Ship Lifestyle.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0